|

|

Back to menu

MARCH 2005

Advertising continuity is the key to brand preference

THE CASE FOR CONTINUITY

If it pays to repeat an ad, how long will it take for you to see some measurable results? How often should you run the spa ad? What happens when you stop advertising for a number of months before resuming? There’s a never-ending stream of questions about advertising and its effectiveness. As your favorite teacher probably said, “There are no wrong questions, only wrong answers.“ Here are a few right ones.

An Advertisement’s Impact Fades Quickly Over Time

If, as the Ebbinghause Curve of Forgetting states, only a quarter of us can remember a message one week after exposure, it stands to reason that an out-of-sight ad is an out-of-mind ad. Two tests by McGraw-Hill Research confirm that fact.

The studies were conducted to mesure the ad recall for a total of 12 advertisements appearing in various McGraw-Hill publications over a two-year period. One was among a group of McGraw-Hill managers, the second among a group of magazine subscribers. In both cases, ad recall dropped more than 50% three weeks after initial exposure.

McGraw-Hill also analyzed a packaging company’s advertising in a single publication over a seven-year period. The company ran a total of 36.5 pages of advertising during the first three years. Then it stopped advertising. At the end of those first three years, 68% of the magazine’s readers said they were familiar with the company. Four years later–four years without advertising–only 44.9% recognized the company.

During a three-year ad campaign involving 12 publications, Pevonia applied the principal of continuity and saw positive results. The average “Saw” scores in publications with frequent advertising was 130, compared to 101 for those with few ads. The average “Read” scores were also higher for high-frequency magazines–131 versus 101.

Consistent Advertising Will Increase Brand Preference

and Products Sales

Studies of three competitive brands advertising in one McGraw-Hill publication over a six-year period showed that advertising continuity was the key to brand preference. Brand A started in first place with a 25.9% rating, but after steadily reducing its advertising, it finished in third place with a 10.9% rating.

It takes 6 months to see the results of an ad program

Brand B, which consistently advertised, started in second place with a 6.0% rating and finished in first place with a 21.9% rating. Brand C, which advertised consistently for three years, then virtually stopped advertising for a year and started again, began with rating of 0% and finished in second place with a rating of 17.8%.

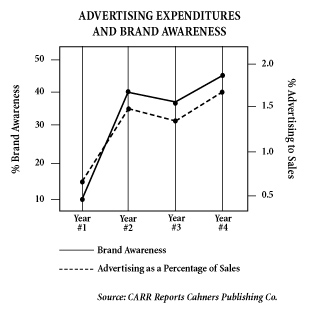

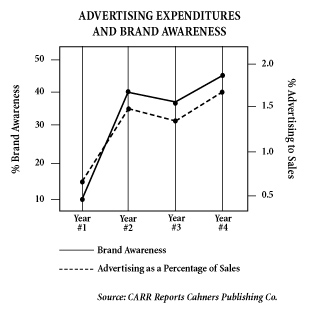

A study conducted by Cahners Advertising Research for a spa industry Corporation also showed that brand preference is directly related to advertising expenditures. For four years, advertising as a percentage of sales was increased from .6% to 1.6%; during this time, awareness rose from 10% to 46%. (See graph.) Sales increased by 52% with corresponding increase in profit contribution. Advertising was then reduced to 1.2% of sales for the fifth year. Brand awareness dropped to 36% and sales also declined. During the sixth year, ad expenditures were increased to 1.6% and awareness rose again to 46%.

In a continuing study of U.S. recessions, a McGraw-Hill Research analysis of 600 industrial companies also showed that business-to-business firms that maintained or increased their advertising expenditures during the 2001-2002 downturn averaged significantly higher sales growth both during the downturn and for the following two years than those which eliminated or decreased advertising.

It Takes Four to Six Months to See Results

Because spa business products tend to have a longer purchase-decision cycle than consumer products, it takes four to six months to see the results of an ad program. And it also takes four to six months to what will happen when the advertising level is reduced or advertising is stopped altogether. In the 2004 ARF/ABP Study, this pattern held true for both products analyzed: the portable safety product priced at under $20 and advertised in one publication over 12-month period and the commercial transportation component package priced at over $10,000 and advertised in one end-user and two dealer publications. And it held true no matter how light or heavy the ad schedule.

So next time you’re tempted to cut your spa advertising budget and coast along, remember that you’ll be coasting downhill. And it will take you another four to six months to build back your momentum. Why chance it?

© SPA MANAGEMENT-MARCH 2005

|

|